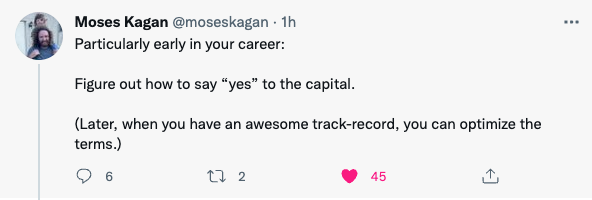

In this episode of the Nick Huber Show, I want to start off by responding to a tweet from a friend of mine Moses Kagen. He said:

In a way I agree. In the beginning, if you have someone wanting to invest in a real estate deal, there is a ton you can learn by getting your hands dirty, doing the deal and worrying about the details later.

On the flip side, to respectfully disagree with Moses, it is easier to do one deal with someone you trust on good terms for you, than it is to do five deals on crappy terms. The rule that I follow is that each property deal needs to be beneficial to the 3 parties involved: The general partner company (the company that raises and manages the cash), the limited partners (the investors), property management companies. If it is only in favor of one side, then that is a bad deal.

The number one mistake I see early GP Companies do when they begin investing in real estate is they do whatever it takes to close a deal without thinking of the effects on the later two parties. The problem with this is they often end up signing for sub-market property management fees which in turn leaves the company cash-strapped and unable to hire anyone to manage the property.

The number two mistake I see is that the GP business entity isn’t set up for success. They fail to charge the right fees, getting the right management fees, putting in the right amount of promotion, etc. In short the company is set up in a way that it won’t end up making a profit.

In line with what Moses Kagen said, true, in some regards doing any deal with sub-optimal terms is better than doing no deal at all, but on the flip side, you would be surprised how often those GPs investing in real estate end up not making any money. What’s the point then?

A lot of new GPs want to raise funds to buy new property that they start chopping off all the ways they make money; they won’t require acquisition fees, no asset management fee, no disposition fee, no refinance fee, etc. The only drive they have is to get back in the game and seal the deal. But not charging these fees puts you in a risky position.

LPs need to have a good return on their investment, so how risky a deal is plays a big role. The greater the risk to the LP investors, the greater return they expect. If you are able to manage risk at a lower level this puts you in a sturdier place. One way you can look at the level of risk you are taking with your leverage is to assess your debt yield. Meaning look at how much profit your acquired debt leverage if making you.

The decision then for you as a GP is would you rather do more deals with lower return on each one or do less deals but each one is far more profitable. From my perspective I would rather spend the time and do the work to find a good deal where I can charge good fees. If not, no deal at all. I’m all about adding value, raising prices, and getting really good at what you do so you can charge good prices. That is my recommendation for you.

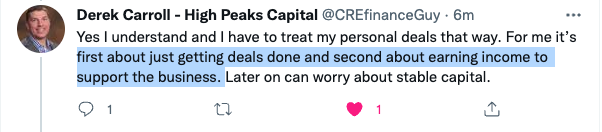

Related to this, let me bring up another tweet that went around:

The way I see it, this is a big mistake that beginning GPs make; it is a wrong way to think about doing your personal deals. If your only focus is on getting deals done and you don’t look at the effect a deal will have on all three branches I’ve mentioned earlier, you are not doing a deal responsibly. Most rely too heavily on getting out of a bad deal later on down the road, which has worked decently for the last several years. But keep in mind that MARKETS CHANGE.

If you close on a deal that isn’t profitable for all three branches, what happens if you get stuck holding on to that asset for five/ten years? That property then begins to make you cash-strapped; the GP is not getting paid nor anyone involved with the property management. This is why I bring up managing risk so often.

My recommendation:

- Charge an acquisition fee small deal up to 3% of the purchase price

- Charge an asset management fee ½ % or 1 % (if doing property management, consider 2%)

- Charge a disposition fee around 1%

- Charge an appropriate refinance fee

In short, anything that takes work for you needs to have a fee associated with it in order to cover costs. Doing this helps you build a sustainable business that can grow and scale. Many LPs will try to talk you out of fees, but this is only because it benefits them. In turn this hurts you as the GP; you can’t function properly without having those fees within your deals. You need to cover your overhead.

To sum things up, it’s all about leverage. It’s all about capital. It is about being attentive to the structure of your deals to make them profitable for all parties. Avoid deals that only benefit one side; these are the deals that will suck you dry.

Three Key Takeaways:

- It is easier to do one deal with someone you trust on good terms for you, than it is to do five deals on crappy terms.

- When investing in real estate, avoid getting caught doing whatever it takes to close a deal without thinking of the effects on all 3 parties involved.

- Anything that takes work for you needs to have a fee associated with it in order to cover costs and be sure a deal is profitable.

The Nick Huber Show is Brought to You By:

Juniper Square

- An incredibly easy way to manage and automate your real estate investment deals with your investors.

- Stay organized and look and stay professional with Juniper Square

- Go to www.junipersquare.com to learn more.

Join like minded individuals who are seeking to improve every aspect of their business through our Real Estate Community. Or, simply subscribe to our podcast for more valuable content to help give you that leg up in real estate.