So you’re ready to put together your first deal. You’ve got your playbook mapped out: buy property, increase NOI or roll-up, create value — and profit.

In this email we’ll discuss the almighty tool – leverage – and how it can both help and hurt you.

On last week’s episode of the Nick Huber Show I answered a lot of questions about how my real estate company is structured, what our employees do, how we source deals and more. Check that out here.

Back to Leverage

Leverage amplifies everything. Every real estate investor I know utilizes it – and they all love it and they all live or die by it.

First of all, this is a double-edged sword. I love explaining how leverage can work FOR investors. It can just as quickly cripple projects and bankrupt investors. There are significant risks with leverage that can sink you if you aren’t careful.

Leverage amplifies gains and losses.

Let’s talk about gains first.

The basic principle is that you realize appreciation not only on the cash you put into the deal (25%) but also the cash the bank put into the deal (75%).

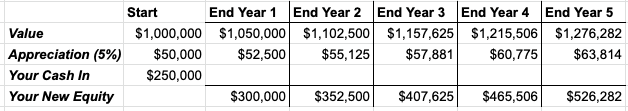

On a property worth $1MM let’s do some math here. Let’s assume appreciation over time at 5% per year for the first 5 years of ownership.

That means the property appreciates by $50k the first year and then 5% every year thereafter.

Your equity over time:

The bank loaned you the money to buy the asset but they don’t realize any appreciation, you just need to pay them back with interest. BUT THE ENTIRE ASSET GROWS.

Even at a 2.5% inflation (remember those days?), this is what it looks like:

Now an important note here:

This may work automatically for residential houses in growing cities, but remember that commercial real estate is valued based on NOI and not rising costs of living.

So how do we raise net operating income and make our property more valuable?

The answer is to raise revenue slowly over time to the point that it out-paces expenses. In self-storage, we raise rents on current tenants 6% every 9 months. We also see a 3-5% annual street rate increase (or more if we are in a market without much supply).

That, evened out, generally means we can grow revenue by 4-6% each and every year even after we are stabilized (already full of tenants).

This is when we need to talk about CAGR.

“Compounding Annual Growth Rate”. How much is each lever in this massive equation changing in a given year?

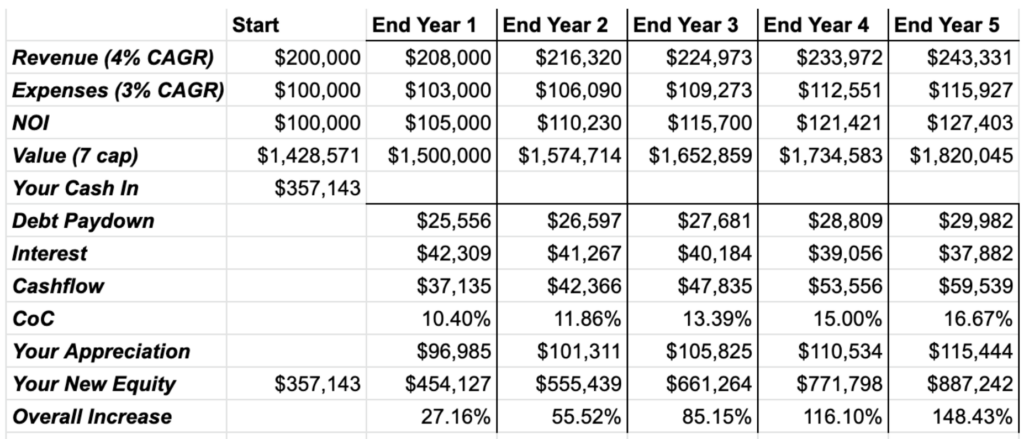

If your expenses grow at 3% and you can increase your revenues at 4% per year, which we try to do in the self-storage business, this is what happens to the value of your equity in the asset over time:

Since your equity is only 25% of the overall pie, and the revenue is already 2x as large as the expenses / assuming a 50% expense ratio here (self-storage is even lower of an expense ratio and these levers are even more powerful), your equity more than doubles in a 5 year period.

This is not a value add deal, it is simply a fully stabilized property chugging along and letting father time work its sweet sweet magic.

And this, my friend, is why I never like to sell real estate. Because over the course of 5 years you can double your amount of equity in a deal just by tugging on a few levers and being a good operator.

But wait, there is more! (I feel like Billy Mays selling magic cleaner)

If we have a 25-year amortization schedule and a 4% interest rate we pay back some debt each year as well. The payment stays the same but you pay off MORE debt each year. The interest amount goes down and the principal amount goes up.

Run an amortization calculator on https://www.amortization-calc.com/mortgage-refinance-calculator/ and you’ll see the magic.

It is like a forced savings account. Yes, it sucks your cash flow, but you are slowly building more equity every single month.

In this example, with a 75% LTV loan at 4% on a 25 year am, we have added back the debt pay-down to your equity number, along with the 4% growth in revenue and 3% growth in expenses:

Your initial $357k in equity (your cash into this deal) has turned into $959k.

How about that for long-term wealth building?

And this isn’t even taking into account cash flow! Let’s see how it looks when we model out our cash flow and get a feel for our overall position on this investment.

Powerful, powerful stuff.

Let’s also discuss the downside.

Real estate is risky. It has created far more bankruptcies than billionaires. And while it’s a beautiful thing that I recommend everyone learns about and explores, it’s not for everyone.

Real estate gets risky when you are dependent on things outside of your control.

We all are, to some extent, I know. We need customers coming in the door, paying rent, and a banker that doesn’t call our loans when times get tough.

But let’s look closer at the risks and how you can lose a lot of money fast.

What factors are outside of our control?

Cap rates. Interest rates. Interested buyers. How much they think it’s worth. If they can close or not.

The truth is that we don’t have much control over any of that stuff. So counting on those factors is inherently risky. Many investors go broke because they count on things continuing on like they had been and something throws a wrench in the cycle. This was any over-leveraged (a lot of debt) investor during the 2008 real estate crisis when values went down 40%+ in a matter of months.

People couldn’t get a loan to buy your property. Cap rates widened (went up). Demand went down. Debt got harder to get. And the folks who were counting on an exit to make money, you guessed it, didn’t make any money. And many of them went broke.

If you buy a value add deal or build a building from the ground up, you need to be prepared to hold for a while longer than you projected. You need to have a plan for cash flow and profitability so if the bottom falls out of the market and it takes five years to recover, you can hold on and, you guessed it, wait.

That is the scary part about this entire game.

Let’s say instead of NOI increasing COVID hits and 40% of your tenants can’t pay rent. Or if you’re a hotel operator and 90% of your customers are gone for 6 months. And the cap rate on your asset went from a 5 to an 8 overnight. Your $5MM building, with $3.75MM (75%) worth of debt put on it, is now worth $3.1MM, and you not only can’t pay the note, but you owe $650k more than it’s worth if you tried to sell it.

Oh, and selling takes time. And negotiations. They know you are hurting. They know nobody likes hotels right now. They know every day that ticks by is one day closer to the bank possessing the asset and taking your house because you personally guaranteed the loan.

How would that feel?

Many investors felt that in 2009 and watched their life savings evaporate overnight. Homebuilders who spent $80 a SF to build 500 homes that went from being worth $100 a SF in July to $60 a SF in September. Oh, and what about the $70 a SF in debt on them at 7% because it was a short-term construction loan where every day is costing them 1.9 basis points, which is $250,000 portfolio-wide?

Many investors in certain asset classes right now (COVID) are watching their empires crumble. NYC landlords with great, risk-free tenants like J. Crew were paying you hefty NNN leases on 4.5 cap property and watched those tenants stop paying rent and file bankruptcy.

The leverage that can help you make money so fast can also help you lose it. It is like trading stocks on margin.

And if you’re forced to sell the stock because you’re out of money to pay the margin interest, you’re done for.

Real estate is cyclical. Over a 40 year period, you better believe it will get an avg of 3-5% more valuable every year. But in a 4-year timeframe, it could easily lose 20% in value.

So how do we combat this? How do we reduce the risk?

We focus on yield. Cash flow. An asset that makes money, and we don’t need to sell to win. We win every day it puts money in our checking account, and every night we go to sleep, and every weekend we spend time with our friends.

We make sure the DSCR is well above the bank’s lower limit of 1.25x. We make sure our debt yield is over 12% instead of the 10% threshold the bank “likes to see.”

We don’t buy the flashy assets that have appreciated like crazy the last ten years and everybody is really hot on going forward.

We forget about that neighborhood where assets are trading at a 4 cap because the “growth is insane” and “it’s up-in-coming.”

Because if an asset doesn’t cash flow, we are reliant on our cash reserves to float it until it cash flows, or we sell it. And if times get tough, which they do, we are between a rock and a hard place.

Because we only lock in losses if we’re forced to sell. If the bank takes our assets and we run out of cash or if we have to sell our best assets to pay for our worst ones because those are the only ones anyone will buy.

The folks who had cash on hand and played the game right had a heyday in 2011 running around buying assets from all the speculators for pennies on the dollar. Those assets are now worth 3 or 4x as much now that the market got back on its feet and debt became available.

And speaking of debt… this is the single most significant risk factor and what impacts real estate values and cap rates like no other lever.

Because debt fuels the real estate economy, investors are addicted to leverage because they know its power. It amplifies the wins. They can make a ton of money fast, as we previously saw.

But what happens when debt gets harder to get or it gets more expensive?

At the bottom of the cycle, debt is always the problem. It is the lifeblood and oxygen for real estate growth that has been cut off, leaving investors choking and gasping for a lifeline.

As the debt constant goes up (more expensive debt) and the debt yield goes down (lower NOI or cap rates) you can get into trouble really fast and the numbers just don’t work.

And if the numbers don’t work, people don’t do deals. And cap rates widen and property gets cheaper.

Interest rates were at all time lows 6 months ago. They’re still relatively low right now. Cash is sloshing around. Investors are levering up and adding as much debt as possible to their assets. They are inviting the risk.

What should you be doing instead?

Focusing on cash flow. Buy and hold assets that you could keep even if interest rates went up to 8%. So you can weather the storm. And you don’t care what the market does, and you don’t care what your asset is worth to somebody else. You only care about what it’s worth to you. And that cash flow can get you through anything and come out the other side smelling like a rose ready to buy other people’s assets at fire-sale prices.

What about inflation? That is good for real estate, right?

In the long run, yes. In the short run, no.

When they start, inflationary periods are typically bad for cap rates and asset prices because debt gets harder to get. Rates go up, so debt gets more expensive. Bankers have cold feet, so they don’t want to loan money right now with the uncertainty and tough economic times.

When inflation took hold in the 70s, this exact thing happened in the real estate market. By the time the late 70s hit, the FED had raised interest rates up over 10%. By ’82, they were at 15%. What do you think that did to cap rates?

Buildings in NYC no longer even made sense to own in the short term.

The city was giving away buildings and offering massive tax credits to anyone who would buy them and put money into them to keep them operational and safe.

Very few RE owners made it through the debt crisis that followed as lenders closed their doors and NOBODY got loans. I recommend reading “Risk Game” by Francis Greenburger if you are interested in this time period. It is absolutely fascinating what those guys went through and how they got through it.

So while the cash-out-refinance is a thing of beauty and leverage is amazing, they can be equally as dangerous.

If you lever up to 75 or 80% LTV during the good years and a correction comes along of 20-25% your equity has vanished. So if you need to sell you lose EVERYTHING.

Scary stuff.

But an important note:

There is always somebody calling the shot and screaming from the mountains that the sky is about to fall.

It is easy to be a bear. There are always many reasons why something won’t continue to go well or start going well. Ask all the folks who shorted Tesla in July of 2020 how that went for them? Ask the folks who said Facebook stock was at its top in 2015 how that went for them? What about the HUGE ECONOMIC RECESSION that COVID would send our economy and the stock market into for many years to come?

It very well could happen. I worry about it and plan for it and think about it a lot. I spend most of my energy protecting against that downside tail event. But remember…

You don’t get wealthy by being a bear. You get wealthy by betting on progress and growth and improvements and adding value throughout that process.

Nick