In this episode of the Nick Huber Show, I’m going to do a deal breakdown of how my property management startup, Huber Property Management, has gone about buying self-storage facilities. We currently own 25 properties, but also have 17 more under contract”“one of those closing at the time this episode goes live. Each of these have their own set of projections, plans, ideas, and visions. I want to go in depth to tell you what we were thinking when we acquired an asset, how it went, how it’s going, and several other helpful points along the same lines. In this episode specifically we focus on an interesting deal in rural Pennsylvania that I posted in my Twitter thread.

This self-storage facility was the 7th deal that partner Dan and I closed back in December of 2020 and it was our 3rd property deal in rural Pennsylvania. Despite this property having been listed on the market for 2 months at $1.4 million, we were only able to talk the seller down to $1.3 million. To paint the picture further, this was a 31,400 sq ft facility in a small town of only 3000 people; we’re talking an old-school run business: paper ledgers, no credit cards, no online rentals”“you get the idea. On top of that, not only did we have to look 10 miles out to find a similar facility that was full, the rent was under market value forcing us to raise rent 30%, which made us anticipate losing 30% of the current occupants. In short, it wasn’t looking like there was much of an upside to this deal. How did we manage?

After closing for $1.3 million, we still had closing costs and CapEx, all-in $1,404,000. That was about $104,000 in extra closing costs. We financed 75% of the purchase price, $975,000, through a local bank, luckily convincing our banker to give us one year interest-only 4.25% interest rate with a 25-year amortization schedule, personally guaranteed by me and my business partner. We raised $225,000 of outside capital and we put in $204,000 of our own cash into the deal making the total cash-in about $430,000. That’s about 30% of the total cost. I know, that’s a lot!

But here’s how we turned this in our favor:

We closed on the last day of 2020. Because of this we were able to deduct all of our bonus depreciation: $314,000 of bonus depreciation on a $1.4 million all-in project. That means of our $430,000 initial investment in cash, we got a $314,000 tax right off that year. That’s almost a full on cash-in tax deduction.

Now, what were we projecting to happen?

Originally it was only making $13,000/mo. in revenue when we acquired the facility. This wasn’t as much of a concern for the previous owner since he only had about $45,000/yr in operating expenses…but that was because he had no property management team, no labor cost, lower property taxes, and was scarily under insured. We projected that if we raised rent, that would raise revenue to an average of $15,800/mo. for the first year of operations.

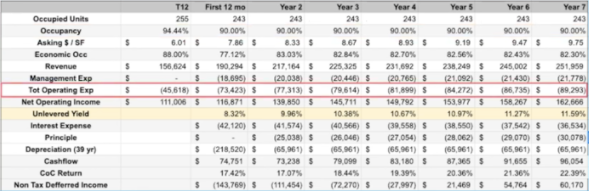

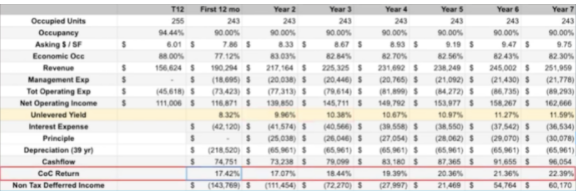

Our plan for managing the operating costs was to wrap the real estate investment in technology: We installed security cameras, provided online payment to customers, increased our visibility and presence online, etc. With all of these improvements, we projected our operating cost to be closer to ($73,423) per year which was okay because we increased our monthly revenue to +$15,000/mo. With that plan it would generally produce about $116,000 of net operating income leaving year one with an 8.32% unleveraged yield. That’s basically the cap rate.

In our cash flow below you can see the total operating expense in the first 7 years of having the facility. Basically, we were trying to grow from an 8.32% unleveraged yield to almost a 10% by year two and year three. When it comes to cash on cash return, we were projecting year one at a high 17.42%, this because we thought it was going to be a good year with the increased revenue. Year two, when principal would kick in, CoC Return would drop to 17.07% bounce back over time.

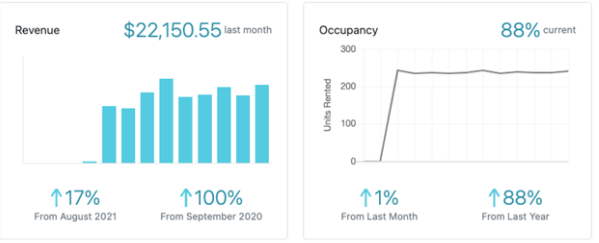

As mentioned earlier, we were concerned that when we raised rent by almost 30% to 35% we would lose a chunk of the current occupants, but, to our surprise, most of the customers stayed and the ones who did leave were immediately replaced with new customers. Why was this the case? We added value through new amenities; customers appreciated the convenience and added features. This increased our revenue and occupancy:

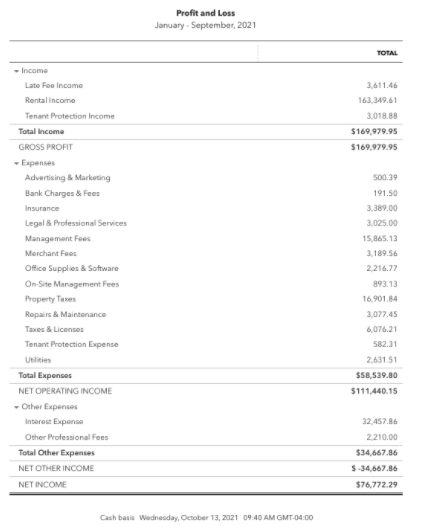

We started cranking! We went from $13,000 a month to $18,000 in monthly revenue almost immediately, we completely crushed our $15,000 revenue projection. We projected 138,000 in revenue in Q1, Q2, & Q3 and ended up hitting $169,000 in revenue surpassing our projections in year one by 22%

After our interest expense, we’ve brought in $76,000 in cash in the first three quarters. Our economic occupancy is 94%. When we underwrote this deal we projected this to be about 80% – 85%. We absolutely crushed it.

So what about the cash on cash return?

We had $43,000 of interest expense and $109,000 in cash flow after interest expense. So $109,000 in cash flow, $423,000 cash invested. That is north of 25% cash on cash return year one. Simply put, this performed beyond our wildest dreams. And here’s the kicker: if you value the facility based on net operating income, this property is now worth about $2.5 million. Remember we bought this self-storage facility for $1.3 million (all in for $1.4 million) Through smart financing, improved property management, and increasing value to the customer, we’ve created about one $1 million in enterprise value in 9 months.

How is that for self-storage income?

Three Key Takeaways:

- When buying a self-storage facility, seek for the best deal available. If you don’t particularly find it in the property itself, hustle to make it profitable through favorable financing deals.

- Take every opportunity to seek tax deductions in your real estate investments to reduce the taxable income.

- Increasing the value of your investments through quality property management, technological infrastructure, and driving revenue.

The Nick Huber Show is Brought to You By:

Juniper Square

- An incredibly easy way to manage and automate your real estate investment deals with your investors.

- Stay organized and look and stay professional with Juniper Square

- Go to www.junipersquare.com to learn more.

Join the Real Estate Community for more valuable content like this, where like minded individuals seek to improve every aspect of their business, or simply subscribe to the podcast.