In this episode of the Nick Huber Show, we are going to look at three things:

- I’m going to tell you what keeps me up at night

- I’m going to give you an update on my portfolio

- I’m going to break down the Q3 of REIT self-storage earnings calls.

What keeps me up at night? Being stuck with all the investments that I have leveraged and having that debt called in by the lender without the ability to re-capitalize or refinance those loans––having to come up with some $49 million to pay back to the bank. That’s scary! That’s the way many end up broke, forcing them to file for bankruptcy.

Let me explain:

You may or may not fully understand what caused the great financial crisis back in 2008, but likely you may know that many real estate investors went bankrupt. It would be tempting to think that this was because they either ran out of money, were over leveraged on their capital, or didn’t have enough cash flow, but this is not completely true. Many investors actually followed many sound principles of leverage and cash flow. What happened was their loans matured; their loans reached the end of their term.

What do I mean by that?

90% of real estate investors file for bankruptcy because their loans mature and the bank no longer has the obligation to service the loans. Because of this, some banks choose to call in the loan rather than allow for borrowers to refinance the loan. In turn, many investors do not have the capital to pay back the loan. During the Great Recession, many of these residential loans had reached the end of their term and banks called them in. Because many borrowers defaulted on their loans, it caused a chain reaction starting with the banks losing out on the money due, all the way up the investing chain of hedge funds, and eventually, to the stock market.

Similarly, in real estate investing, banks only want to keep loans on their books for so long; often this is for a much shorter period of time than residential mortgages––some 3 years, some 5. At the end of the term, banks generally prefer to call in these loans so they can reinvest it in longer term investments; this is what they call bridge financing. When it comes to an investor like me, as mentioned above, I have $49 million in bridge financing that, if for some reason I was unable to reinvest or refinance, I would have to come up with the money to pay back these loans. I am forced to ask myself the same question I asked in our previous episode: how do I try to minimize this risk?

What our company is doing is re-capitalizing on loans from the self-storage facilities that we bought a year and a half ago. What does that look like? We are taking the short term loans from investment properties that we increased the property value of, and re-capitalizing those loans into longer term debt. This decreases the risk of our debt maturing and having to come up with capital to pay it all back.

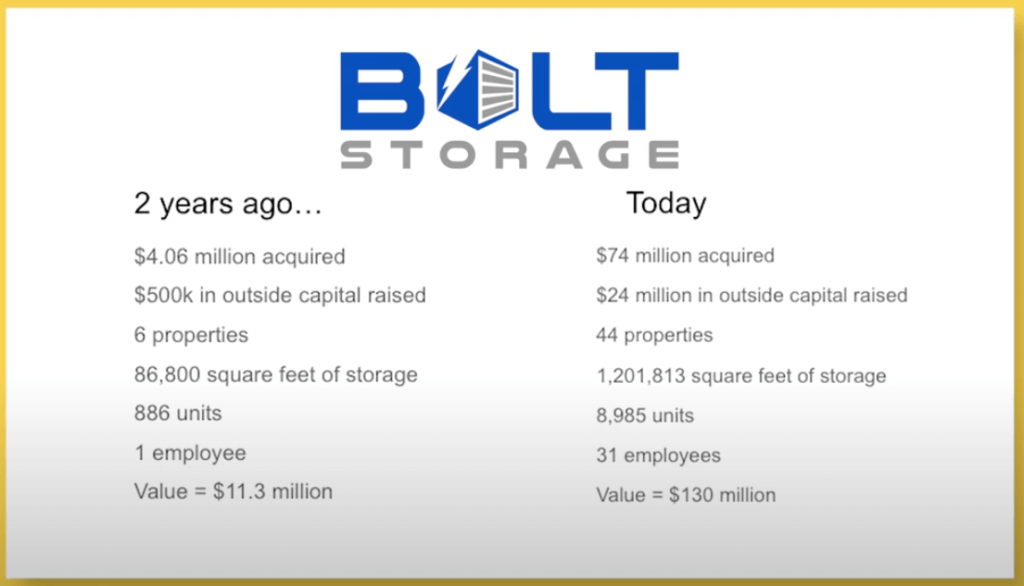

Looking back at all of this, it makes me reflect on how far we have come when it comes to my portfolio over the last two years. Two years ago, we had a service company. It wasn’t very successful and only valued at $1 million dollars. We had $4.6 million worth of self-storage facilities that we had acquired for a total of 86,000 rental square feet with 886 units. Through all of this, we had only had one designated full-time employee for this self-storage: me. There was no other team, I hadn’t learned yet how to make quality hires or how to build out systems to take myself out of my company. It was just me.

How have things changed over the last two year?

Today, we have $74 million worth of self-storage that we’ve acquired––$24 million in outside capital raised. We will have 44 properties by the end of the year; that is 1.2 million square feet of storage; that is 8985 units with 31 full-time employees. Because of this, it puts us in the top 20 of private operators in the country. Included in all of this, we run a real estate private equity company and a property management company. All in all, the value of our portfolio is now worth $130 million!

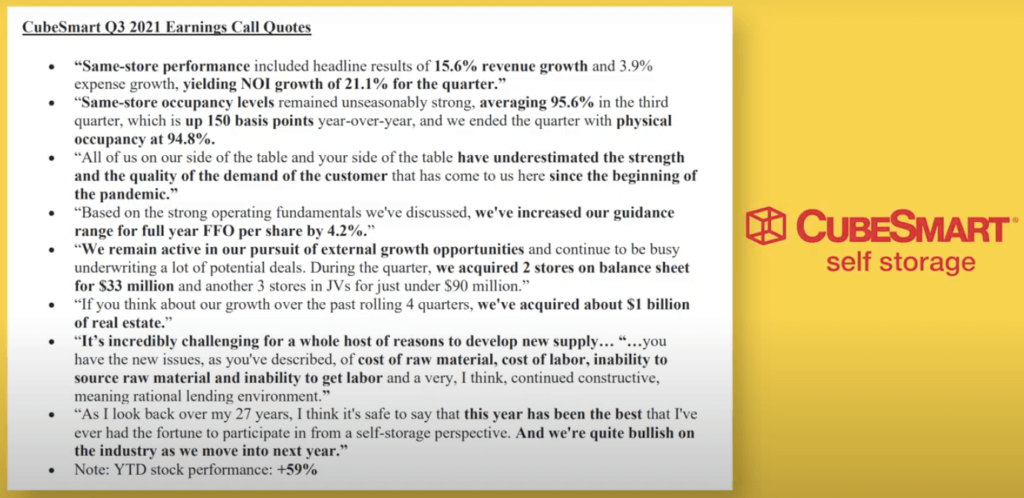

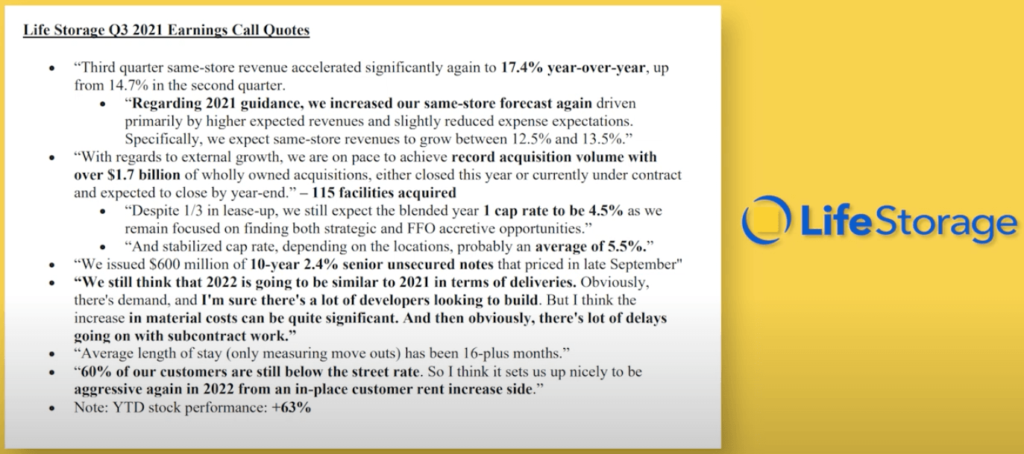

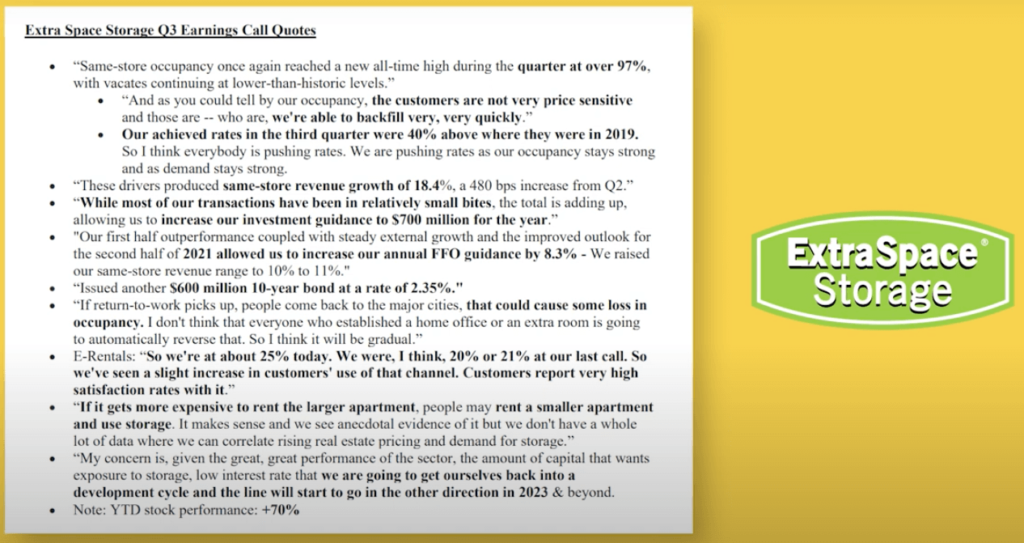

Lastly, I want to analyze the self-storage industry for the third quarter. This report comes from the earning calls for CubeSmart, Life Storage, Extra Space, and Public Storage:

Starting with CubeSmart “Same-store performance included headline results of 15.6% revenue growth…” That means that one single store’s year over year revenue growth was at 15.6%. To put that in perspective, Google, one of the fastest growing tech companies of all time, had a similar estimated revenue growth of 15%. Not to mention, there was a NOI growth of 21.1% for this quarter. That is absolutely astounding! This shows how great an industry this is; I feel lucky to have landed in self-storage when I did.

Comparing this to Life Storage following, there was a similar trend: “Third quarter same-store revenue accelerated significantly again to 17.4% year-over-year, up from 14.7% in the second quarter.” But on top of this, when it comes to their external growth, they reported, “…we are on pace to achieve record acquisition volume with over $1.7 billion of wholly owned acquisitions, either closed this year or currently under contract and expected to close by year-end.” Wow! That’s amazing growth. But even more, Life Storage reported: “60% of our customers are still below the street rate. So I think it sets us up nicely to be aggressive again in 2022 from an in-place customer rent increase side.” This means that they physically can’t raise their rates high enough to keep up with the street market rate; that’s a good problem to have.

Jumping into the report on Extra Space Storage, “Same-store occupancy once again reached a new all-time high during the quarter at over 97%, with vacates continuing at lower-than-historic levels.” They added, “…as you could tell by our occupancy, the customers are not very price sensitive and those who are, we’re able to backfill very, very quickly.” To sum it up, Extra Space Storage is “…pushing rates as our occupancy stays strong and as demand stays strong.” Demand is high and there is a need to be filled in this industry.

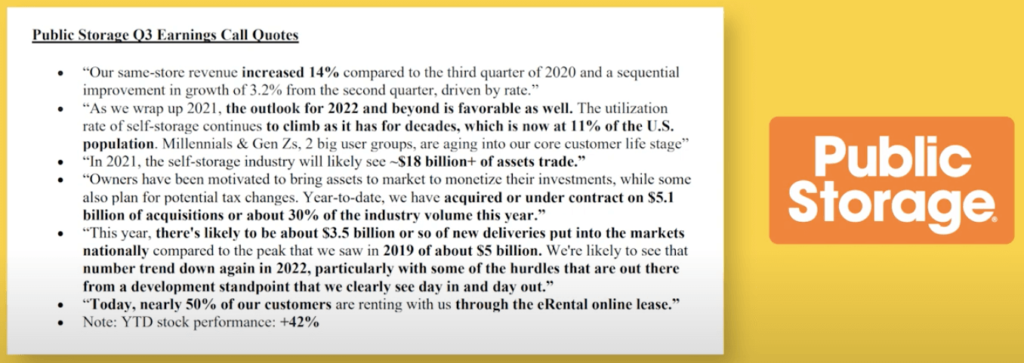

As for the last one in the group, Public Storage, they reported: “In 2021, the self-storage industry will likely see ~$18 billion+ of assets trade.” Which is remarkably high; in perspective, I only own $100, million of that. $18 billion, that completely blows my mind. But perhaps something particularly fascinating, outside of this they said, “Today, nearly 50% of our customers are renting with us through the eRental online lease.” This is exciting for a company like ours that only does online rentals. The customer’s adoption of online renting is going up at a fast rate.

Overall, this has been a good ride. Making my income by buying self-storage real estate has been an amazing thing for me. With all these numbers mentioned here, along with the full reports from these companies, show that this is a booming industry. Picking a business is hard. From my perspective, figuring out what type of business to get involved with is more important than being actually good at business. Because of that, it is easy to get arrogant and think you are the greatest at managing your business but reality is you picked a great industry. Self-Storage real estate is blowing up and the outlook for those involved in it can definitely cut out their piece of the pie.

A great way for you to learn how to jump into the real estate industry is through our online real estate courses.

Three Key Takeaways:

- 90% of real estate investors file for bankruptcy because their loans mature and the bank no longer has the obligation to service the loans.

- In order to minimize risk against banks, it is wise to take short term loans from investment properties and re-capitalize those loans into longer term debt.

- Figuring out what type of business to get involved with is perhaps more important than actually being good at business.

The Nick Huber Show is Brought to You By:

Juniper Square

- An incredibly easy way to manage and automate your real estate investment deals with your investors.

- Stay organized and look and stay professional with Juniper Square

- Go to www.junipersquare.com to learn more.

Join like minded individuals who are seeking to improve every aspect of their business through our Real Estate Community. Or, simply subscribe to our podcast for more valuable content to help give you that leg up in real estate.