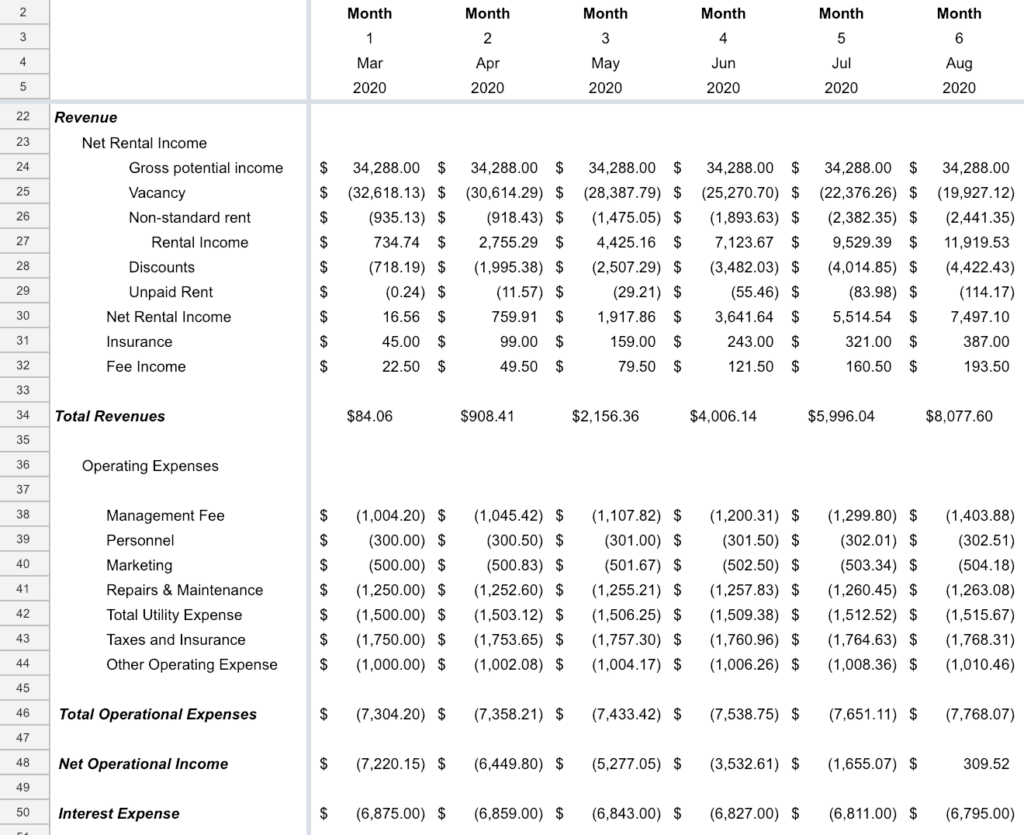

A pro forma financial projection model is your best friend.

Use Excel or Google Sheets to build out your models and do a lot of research on your industry standards and fill in blanks with actual expenses and revenue estimates per customer.

Costs will vary at different customer levels so make educated (and research based) estimates based on customers per month. At 10 customers per month go down each line expense item and build the model so that the overhead and variable costs are accounted for.

Then create formulas based on the customer fluctuations.

Run at least 3 models to account for uncertainty and variability. You will need a “worst case” model, an “expected case” model and a “best case” model with different customer figures.

Remember there is bias here and people are more likely to overestimate customer numbers, revenue and underestimate expenses.

Can you still pay your bills in the worst case model? If the answer is no this is a high risk model and you need to make a plan for this situation. How will you liquidate your equipment? How can you get out of your overhead?

Before you hit the ground there will be a ton of variables that you cannot possibly put an accurate figure on. As you operate yourself and collect data you can begin to fill in the blanks.

This is a living and breathing document that should be updated monthly and revamped, studied and used to get the big financial picture and minimize your risk.

If you make every financial decision at your business with this document as reference you will be much more likely to win.

Check out my sample pro forma here: